How To Remove Bank Account Details From Paytm

- How To Remove Bank Account Details From Paytm Phone

- How To Remove Bank Account Details From Paytm Business App

- How To Remove Bank Account Details From Paytm Customer Care

To make updates to any bank account, you will have to remove the bank account and then add it back. To delete a bank, you will have to click on the VPA, which will. Effectively, you cannot login to Paytm anymore with these tokens; Balance transfer from your Paytm account to another Paytm account or bank account is allowed only after KYC as per the RBI guidelines dated October 11, 2017, Para 9, Point no. 9.1 (i) (g) and (k). Paytm UPI allows users to send money from one bank account to another bank account. The process is also very simple. As Paytm explains, all one needs to do is link their Bank account with Paytm UPI and then start sending money to any Bank account or UPI ID which is linked with the person’s Bank account.

Paytm FASTag is a simple and reusable tag based on radio-frequency identification technology (RFID) that will be affixed on a vehicle’s windscreen. Each FASTag is linked to a registered Paytm Payments Bank wallet / account to facilitate instant automatic deduction of toll charges. This program is part of the National Electronic Toll Collection (NETC) initiative rolled out by NPCI under the guidelines of NHAI & IHMCL.

Only one FASTag can be issued against any particular vehicle at any given point of time, in case customer reaches to PPBL for new FASTag issuance, customer has to ensure that earlier issued FASTag against same vehicle are destroyed and demolished. In case the customer fails to destroy the FASTag, he will be charged from both the FASTags/accounts until one of them is destroyed/deactivated and inform the earlier bank that issued the FASTag. The below Terms and Conditions apply to the RFID enabled prepaid FASTag (“FASTag”) facility made available to you (“Customer”) by Paytm Payments Bank Limited (“PPBL”).

- By submitting the application, the Customer shall be deemed to have agreed and accepted the Terms and Conditions. PPBL may issue the Paytm FASTag only to Customers who are making this application for the FASTag and agreeing to the applicable terms and conditions in the form and manner prescribed by PPBL from time to time.

- The FASTag shall be solely used for the purpose of making applicable toll payments at designated Toll plazas on the highway through the electronic toll collection (“ETC”) enabled lane. The list of designated toll plazas is made available at www.paytm.com/FASTag.

- The Customer who wishes to avail the FASTag shall be required to have standard Paytm Wallet, within which a sub wallet (i.e. FASTag Wallet) shall be created. Such wallet (FASTag Wallet) shall have predefined monetary limits.

- Wallet holder may also get access to the FASTag Wallet which will be a part of the Paytm Wallet and the maximum monetary limit as specified in the RBI guidelines and amendment from time to time shall apply to the combined limit of the Paytm Wallet and FASTag Wallet.

- Any charge levied by the establishment on the purchase made by the FASTag wallet holder using the Paytm FASTag wallet shall be settled by such Paytm FASTag Wallet holder with the establishment directly and PPBL shall not be responsible for the same.

- All spends by Wallet holder from the FASTag Wallet should be in compliance with the applicable laws. Wallet holder agree that FASTag Wallet shall be used by FASTag Wallet holder solely for the purpose of purchase of ETC enabled toll tickets from relevant establishments who have agreed to redeem the amount from the FASTag Wallet section and have an arrangement with PPBL in this regard.

- FASTag Wallet holder agree and confirm that no P2B (Personal to Bank transfer), P2P (Peer to Peer) and no cash out are permitted from FASTag Wallet balances.

- Paytm FASTag can also be purchased through E-commerce channel. Once customer provide the details, FASTag to be sent to Customer through courier services at the address provided by the Customer.

- Based on the information provided by the customer through the online form, customer’s Paytm FASTag will be allocated to Vehicle detail provided.

- Customer has to provide the original vehicle registration copy for tag issuance activity.

- PPBL may ask for other necessary details as in vehicle details, photograph of vehicle with FASTag affixed on it, as part of mandatory documents for Paytm FASTag activation in order to validate the documents.

- It is customer’s responsibility to make sure that Paytm FASTag ordered against vehicle is affixed on same vehicle.

- FASTag Wallet holder shall prior to availing the FASTag Wallet services from PPBL obtain appropriate advice and shall familiarize himself with the associated risks and all the terms and conditions pertaining to the FASTag Wallet Service. FASTag Wallet holder further verify all facts and statutory provisions and seek appropriate professional advice including the relevant tax implications.

- The FASTag Wallet holder agrees that he/she will not use the Paytm FASTag Wallet for payment of any illegal/unlawful purchase/purposes.

- In case of termination/cancellation of single FASTag mapped under wallet having multiple FASTag issued, FASTag wallet service will continue.

- The FASTag Wallet holder shall agree to submit all the documents with the PPBL as directed from time to time, to meet KYC / KYV / KYB norms in compliance with the relevant extant guidelines of the Reserve Bank of India.

- The FASTag Wallet holder shall forthwith notify the PPBL of any change in his/her address for communication as submitted with PPBL at the time of activating Paytm FASTag Wallet. The responsibility shall be solely of the FASTag Wallet holder to ensure that PPBL has been informed of the correct address for communication.

- The FASTag Wallet holder shall act in good faith at all times in relation to all dealings with the PPBL.

- The FASTag Wallet holder shall be fully responsible for wrongful use of the Paytm FASTag Wallet.

- The FASTag Wallet holder shall indemnify PPBL to make good any loss, damage, interest, or any other financial charge that PPBL may incur and/or suffer, whether directly or indirectly, as a result of FASTag Wallet holder committing violations of these Terms and Conditions.

- The FASTag Wallet holder will indemnify and hold PPBL harmless for any / all actions, proceedings, claims, liabilities (including statutory liability), penalties, demands and costs, awards, damages and losses arising out of wrongful use or cancellation (wrongful or otherwise) of a Paytm FASTag Wallet Service.

- The Customer need to inform PPBL of any loss or theft of PPBL FASTag. In case the Customer finds a lost or stolen FASTag, please inform PPBL immediately. Any loss or theft of the FASTag shall be immediately reported to a PPBL, also same shall be reported to police station and an FIR shall be registered, if required

- The PPBL shall at no time be responsible for any liability arising out of or in relation to the lost or stolen FASTag or any misuse of the FASTag by any of the Customers or its representative. FASTag issued to the Customer shall at all times remain the property of PPBL and shall be surrendered to PPBL, on request. In case of replacement of FASTag, Customer will be charged with the replacement fee. FASTag is non-transferable but can be cancelled as per the policies of PPBL. For any charges related concern please visit our web page www.paytm.com/FASTag

- In case the FASTag remains unused or wallet is not refilled for a period of 6 months with a due balance amount, the FASTag Wallet will be closed with prior intimation to the Customer and such FASTag shall not be accepted at any Toll Plazas for the purpose of payment of toll.25. At any stage Customer’s FASTag wallet threshold balance gets exhausted due to transactions done at the toll plazas and wallet reaches to a due balance state, due balance will be adjusted from the Customer’s security amount deposited at the time of FASTag issuance. Customer has the rights to suspend / terminate the FASTag services for the desired period / permanently respectively either by Paytm Customer Support or by web portal.

- On termination of the FASTag any outstanding amount, whether or not already reflected in the statement and, the amount / charges incurred after termination, shall become forthwith due and payable by the Customer as though they had been so reflected, and interest will accrue thereon as may be applicable as per PPBL policy/process from time to time.

- The Customer shall continue to be fully liable for PPBL for all charges incurred on the FASTag prior to termination.

- Notice of termination or request to surrender of the FASTag shall be deemed given when a notice posted to the mailing address/email ID of the Customer, as per the records Of PPBL is received by the Customer through ordinary post/email. The Customer agrees to surrender the FASTag of PPBL, or its representative, upon being requested to do so. The Customer may not use the FASTag notice of termination has been received by him/her.

- PPBL FASTag is valid in India only.

- The FASTag issued by PPBL to the Customer shall be mandatorily affixed by the authorized representative of the PPBL on the vehicle of Customer with the license plate number specified by the Customer in the application. The FASTag is not transferable and only be used for the specific vehicle on which the FASTag has been affixed by the authorized representative of the Bank.

- At the time of making the application for issuance of the FASTag, The Customer shall be required to pay a minimum amount (please see web page for information on FASTag charges – www.paytm.com/FASTag) as FASTag fee plus applicable taxes, threshold amount and also the security deposit as per the type of the vehicle with a maximum limit of Rs.1, 00,000 (Rupees One Lakh only) at any given point of time or such other limit as may be specified by the PPBL subject to Internal and Applicable regulatory and statutory guidelines.

- The FASTag shall be activated subject to approval of application by the PPBL and a minimum amount being loaded on the FASTag by the Customer such funds shall be loaded on the FASTag after deduction of applicable charges/fees etc., payable by the Customer to PPBL for availing the FASTag.

- Customer shall ensure to keep the FASTag safe. The Customer shall be bound to comply with these terms and conditions and all the policies stipulated by PPBL from time to time in relation to the FASTag. PPBL may, at its sole discretion, refuse to accept the application and to issue the FASTag to the Member.

- The PPBL shall at no time be responsible for any surcharge levied and debits made at the Tolls.

- All transaction undertaken at a participating Toll plaza shall be conclusive proof that the charge is recorded or such requisition was properly incurred for the amount by Customer using the Paytm FASTag except where the FASTag has been lost, stolen or fraudulently misused, the burden of proof for which shall be on the Customer.

- Customer shall at no time exceed the expenditure at the toll plaza than the amount available in his wallet.

- PPBL reserves the right to bill the Customer for any due balance in its sole discretion.

- The Customer agrees to pay PPBL promptly for the due balance.

- PPBL also reserves the right in its sole discretion to cancel/terminate the FASTag should the Customer create one or more due balance with the FASTag.

- FASTag activation takes 24-48 business hours post issuance.

- PPBL reserves unto itself the absolute discretion to decline to honor the transaction requests on the FASTag, without assigning reason thereof.

- Customer reserves the right to cancel his/her account / wallet at any time after submitting such documents and information as may be required by the PPBL and also return the FASTags. The balance amount (if any) remaining in the related to FASTag would be returned to Customer in his Paytm Wallet

- PPBL Customer care can be reached for any enquiries pertaining to the FASTag. Customers shall immediately inform the PPBL in case they find any irregularities or discrepancies in any transaction undertaken with the FASTag.

- The Customer will be liable to pay PPBL, upon demand, all amounts outstanding from the Customer to PPBL.

- The holding and use of the FASTag will incur fees which will be debited to the balance available in the Paytm Wallet Account.

- FASTag issuance fee is non-refundable.

- Any Government charges, duty on debits, or tax payable as a result of the FASTag shall be the Customers responsibility and if imposed upon PPBL (Either directly or indirectly), PPBL shall debit such charges, duty on tax against the balance available on the FASTag there will be separate service charges levied for such facilities as may be announced by the bank from time to time and deducted from the balance available on the FASTag. In the situation that the balance available on the FASTag is not sufficient to deduct such fees, the Bank reserves the right to deny in further transactions. The Customer also authorizes PPBL to deduct from the balance available on his Paytm Wallet to balance out the FASTag minimum threshold balance, and indemnifies the PPBL against any expenses it may occur in collecting money owed to it by the Customer in connection with the FASTag. (Including without limitation reasonable legal fees). PPBL may levy services and other charges for use of the FASTag, which will be notified by the Customer from time to time by updating this terms and conditions. The Customer authorizes to recover all charges related to the FASTag as determined by PPBL from time to time by debiting the balance available on the Paytm Wallet. Details of the applicable fees and charges as stipulated by PPBL shall be displayed on the website.

- The Customer agrees to indemnify and keep indemnified PPBL against all and any claims, suits, liability , damages, losses , costs charges, proceedings, expenses, and actions of any nature whatsoever made or instituted against PPBL or incurred by PPBL on account of usage of the FASTag. “PPBL may, at its sole discretion, utilize the services of external service provider/’s or agent/’s and on such terms as required or necessary, in relation to its products/services

- PPBL shall be providing copies of the Transaction slips to the Customer also transactional alerts through short messaging system message on the registered mobile number for that FASTag with the Bank.

- The Customer hereby agrees to indemnify and hold PPBL indemnified from and against and all actions, claims, demands ,proceeding ,losses ,damages costs, charges and expenses whatsoever which the Bank may at any time incur or be put to as consequence of or by reason of or arising out of providing the FASTag to the Customer or by reason of PPBL’s act of taking / refusing / omitting to take action on the Customer instructions, and in particular arising directly or indirectly out of negligence, mistake, misconduct or dishonesty relating to any Transaction by the Customer. The Customer shall also indemnify PPBL fully without prejudice to the foregoing, PPBL shall be liability whatsoever to the Customer in respect of any loss or damage arising directly or indirectly out of any act of any third party including but not limited to the Toll plaza’s deduction of amounts from the FASTag. PPBL’s liability for any and all causes whatever exceed INR5,000/-

- Notwithstanding anything stated under this Agreement, the aggregate liability of PPBL from any and all causes whatsoever shall not in any and all events in the aggregate exceed the sum equivalent to the preceding INR5,000/-

- Jurisdiction – These terms shall be interpreted, construed and enforced in all respects in accordance with the laws of India without regard to any principles of conflicts of laws thereof. Both the Parties agree that the competent courts at New Delhi shall have the exclusive jurisdiction.

- Customer hereby, irrecoverably authorizes PPBL to disclose, exchange, share or part with all the information relating to the Customer/’s details and payment history information and all information pertaining to and contained in the terms and conditions or as expressed in the application made for FASTag affiliates/banks/financial institutions/ credit bureaus/agencies/statutory bodies as may be required and undertakes not to hold PPBL/Its affiliates/ the other group companies of PPBL and their agents liable for use of the aforesaid information.

- PPBL reserves the right in its absolute discretion to amend or supplement any of the terms and conditions, features and benefits offered on the FASTag including, without any limitation to changes affect interest charges or rates and methods of calculation at any time. The balance available on the FASTag shall be liable to be utilized for all charges incurred and other obligations under the revised terms and conditions. PPBL shall notify/communicate the amended terms and conditions by hosting the same on the FASTag website or any other manner decided by PPBL. The Customer shall be responsible for regularly viewing the terms and conditions, including amendments thereto as may be posted on the FASTag website and shall be deemed to have accepted the amended terms and conditions by continuing to use the FASTag.

- PPBL FASTag Cashback is applicable only for successful trips made through NHAI plazas. Currently cashback is not applicable for trips made at State plazas.

- Cashback for FASTAG program is provided by NHAI, kindly refer http://www.nhai.gov.in/national-electronic-toll-collection.htm or http://www.fastag.org/ to get more details on the list of eligible plazas for Cashback along with applicable cashback percentage for the given financial year.

- Terms and Condition may change as per PPBL’s and Governments policy, for changes please refer to our webpage – https://paytm.com/FASTag.

How to Delete Paytm Account Permanently: In this post, I am going to tell you about How you can delete your Paytm account permanently,

After reading this article, you will get the below-given benefits:

- Delete the Paytm account.

- Delete the Paytm Business account.

- Merchant account delete.

- Paytm bank account delete.

- And a lot more.

Let me tell you how you can do all this,

Are you excited to know?

So which Paytm account you want to delete?

Merchant account? Business account? Bank account? or any other account?

If you want to delete any other Paytm account which I had not mentioned in this article,

Then please do inform me in the comment section below,

Furthermore, I am not only going to tell you about How to delete a Paytm account permanently on your mobile,

I will also tell you the detailed steps,

If you want to delete your Paytm account on your desktop and tablets.

So take a deep breath for the reason that this article also covers your topic,

However, Some people also ask how to delete Paytm recharge history? how to delete the Paytm passbook? how to delete Paytm transaction history?

So I also added answers to the above question in the FAQ section down below.

Which will cover everything,

Nonetheless, I have written a few methods down below which will help you understand the same,

Each method is unique and will work on all the devices,

So are you excited to know about the method to delete the Paytm account Permanently?

Also check:

Continue reading below,

Also, make sure to check the FAQs section for all the question which you have in your mind.

How to Delete Paytm Account Permanently:

Method one: Calling Customer Care

1) First of all download the Paytm app from below

2) After that login into the Paytm app using your account details and proceed.

3) Then verify your mobile number with OTP, only if it asks for the OTP.

4) Now click on the menu section and then Goto the 24x7 help section.

5) From there you will get the Paytm customer care number.

6) Or click on the above link to copy the Paytm customer care number.

7) Now call customer care and ask the agent to delete your Paytm account.

8) Your account will be deleted within a few hours after you provide your necessary details to the Paytm agent.

9) The agent also asks you some questions, so make sure to give the correct answers to all the questions.

Method two: Paytm Chat feature

1) To use this method, first of all, download the Paytm app from below

2) After that log in with your credentials and proceed to the Paytm menu section.

3) After that, click on the 24x7 help section and then go to the contact menu.

4) Now click on the live chat feature within the Paytm app.

5) Now you will be able to see some message sent to you by the bot.

6) Type your query in the option field and then choose the other query option in the Paytm app.

7) Then the bot will transfer your chat to one of the Paytm representatives.

8) Now type your query again in the chatbox and ask the Paytm agent to close or delete your Paytm account.

9) They might ask you some questions, so give the correct answer and also give a valid reason to delete your Paytm account.

10) Once the agent satisfies your answers then the agent will initiate the closure of your account from their end.

11) They will ask you to wait at least a few hours and then your account will be deleted on the Paytm app.

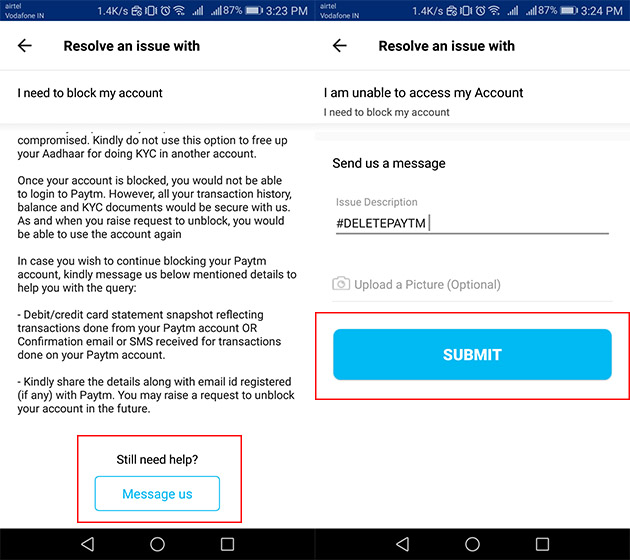

Method three: Paytm Ticket feature

1) First of all head to the below section and download the Paytm app.

2) After that, login into the Paytm app as I told you to do in the above methods.

3) Then proceed and go to the menu section and then goto the 24x7 help section.

4) From there create a ticket and write your issue on the ticket.

5) Within a few hours, the Paytm team will reply to your ticket and may ask for your documents like an Aadhar card or any other.

6) Send your documents to copy using the chat feature on the ticket.

7) Now wait again for a few hours, and the Paytm team will verify your documents and then you further.

8) They also might ask you some questions regarding your account.

9) Now wait for a few hours and your Paytm account will be closed.

More Methods to Delete Paytm Account:

Method four: Change Number

1) To use this method, you also need to download the Paytm app.

2) So head to the below section and download the Paytm app.

3) Then proceed and go to your profile section from the menu tab.

4) After that, click on the mobile number section and then click on the edit option.

5) Then change your Paytm registered mobile number with an unregistered Paytm mobile number.

6) Once you do this, Paytm will send you OTP to your new mobile number.

7) Enter your mobile number OTP and successfully change your mobile number.

8) This method will help you if your mobile number is stolen and you want to delete your Paytm account.

9) Follow this method and then you don’t want to delete your Paytm account.

Method Five: Change Email

1) This method will help you to change your forgotten email id.

2) This way, you don’t need to delete your Paytm account unnecessarily.

3) To use this method, first of all, download the Paytm app from below and then login with your number.

4) Verify your OTP, if Paytm ask to enter the one-time password.

5) Then proceed to and Goto profile section and select your email ID and then click on the Edit option.

6) After doing this, enter your new email id and then verify your new ID by a one-time password.

7) Paytm will send the one-time password to your Email ID, so open Gmail and copy your code.

8) Once you copy the code, enter that code in your Paytm app.

9) You have successfully changed your Paytm email ID without deleting your account.

Method Six: Send Email to Paytm

1) First of all, open your Paytm registered email account (Gmail).

2) After that log in with your Paytm registered email ID and password.

3) After doing login on Gmail, compose an Email.

4) Type Paytm customer care mail-in the “To” field: Care@Paytm.com

5) And then type the subject, of the email as “I want to close my Paytm account”

6) Then enter your email in the box.

How To Remove Bank Account Details From Paytm Phone

7) Now click on the send button and wait for a few hours.

8) Wait at least, 12 hours for a new reply from Paytm.

9) Then follow the steps given in the Paytm email.

10) After following all the steps, your account will be closed by Paytm customer care.

How to Download App to Delete Paytm Account:

1) First of all Goto Paytm app from Google Play Store for Android or from the Apple store for IOS.

2) You can also download the Paytm Business app from Google Play Store or from the Apple store.

3) Now login with your Paytm account and very your mobile number using OTP.

4) Now proceed and click on the top menu section on the left.

5) From there click on the profile section and do what you want to do.

6) You can also follow the above-mentioned methods.

I hope you like this How to delete Paytm account permanently post,

If you like it then don’t forget to share this post,

Check free Paytm cash apps for some extra money, and check some free recharge tricks, free recharge app, for a discount on your recharge.

How To Remove Bank Account Details From Paytm Business App

At this Point Check Related Offers:

Finally Watch Related Video:

How To Remove Bank Account Details From Paytm Customer Care

Watch this video on YouTube